Do Your Own Research (DYOR)

DYOR refers to steps to take before you make investment decisions. Of course, you should do whatever you like, but these steps help you stay more secure and help you better understand how to Do Your Own Research. In that respect, crypto can be similar to the stock market. In general, with some exceptions excluded, you won’t invest in companies you don’t know what they do. How else would you believe the value would go up?

Crypto has some shady side going on as well, for which it is extremely important to DYOR. Because of the many scams, you can’t go into this world unprepared. Therefore we write about the best practices for research here, and have a dedicated security section elsewhere on the site to help you stay safe.

In Crypto it’s better to spend time to gain money, than to save time and lose money.

CryptoKnowhow

To consider while DYOR:

- The team;

- Funding and sources of funding;

- Contract Analyses – Honeypot/Rug Pulls/Clone Scams;

- The Whitepaper;

- Roadmaps;

- Type of coin;

- Partnerships;

- Audits.

Click a topic to jump to the section

The Team

Part of DYOR is a deeper examination of the project’s team is important to consider. Focus on the individuals leading the project, assessing their qualifications, experience, and track record within the industry. Investigate key team members, their roles, and their previous involvements in successful projects. Transparent communication from the team is required to create trust. A proactive approach to community engagement is an indicator of a project’s commitment. Team members with a proven ability to navigate the complexities of the crypto landscape bolster the credibility and long-term potential of the project. But, again, it is no guarantee that if they were successful in the past, they will be in the future.

Funding and sources of funding

A thorough understanding of a project’s funding sources is a major factor to focus on when doing DYOR. Begin by examining the project’s fundraising history, encompassing elements such as Initial Coin Offerings (ICOs), token sales, and investments from established venture capitalists. Analyze the token distribution model to understand the allocation among the team, investors, and the broader community. Also ask yourself: is this project backed by reputable platforms, community-driven initiatives, and distinguished investors?

Contract Analyses

We’ll explain a bit more about contract analyses. Reading smart contracts is crucial to identify potential threats like honeypots, rug pulls, clone scams or one of the many other forms of scam. If you are capable to do so; Conduct a comprehensive code review, look for vulnerabilities and check whether the project has undergone third-party audits. If you aren’t certain, try to invest a tiny amount such as $ 3 to see if you are also able to sell this amount normally. However, keep in mind that even the contract can be written in a way that you can sell small amounts, but not large amounts at once. Token screeners such as Tokensniffer or Isthiscoinascam will provide more clarity. These websites are developed to automatically assess if certain coins are scam or not.

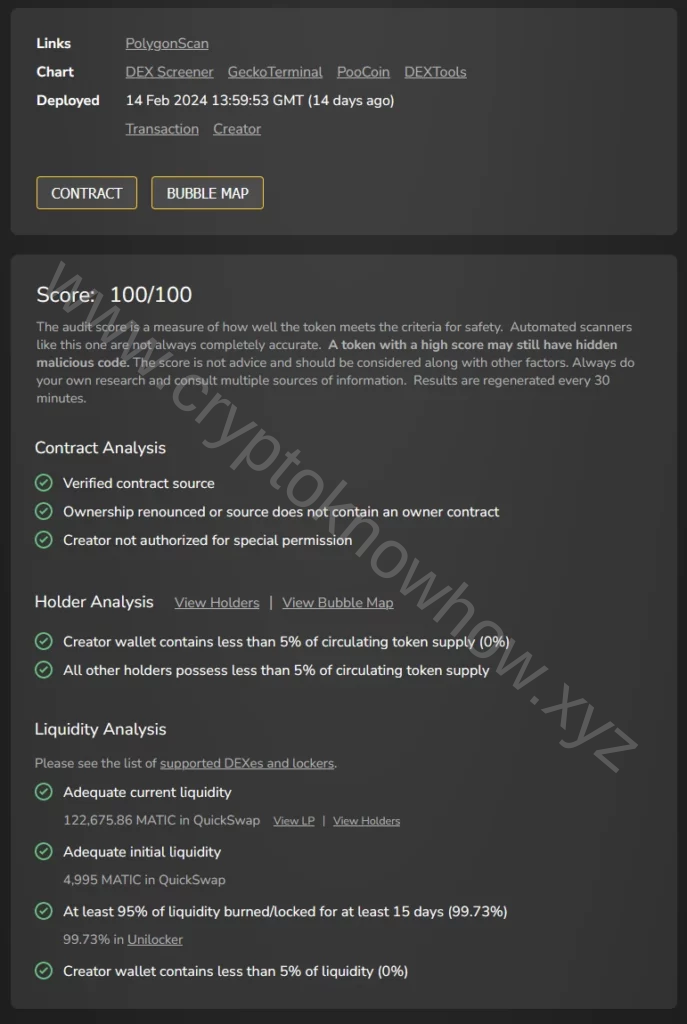

Example of a safe contract in Tokensniffer:

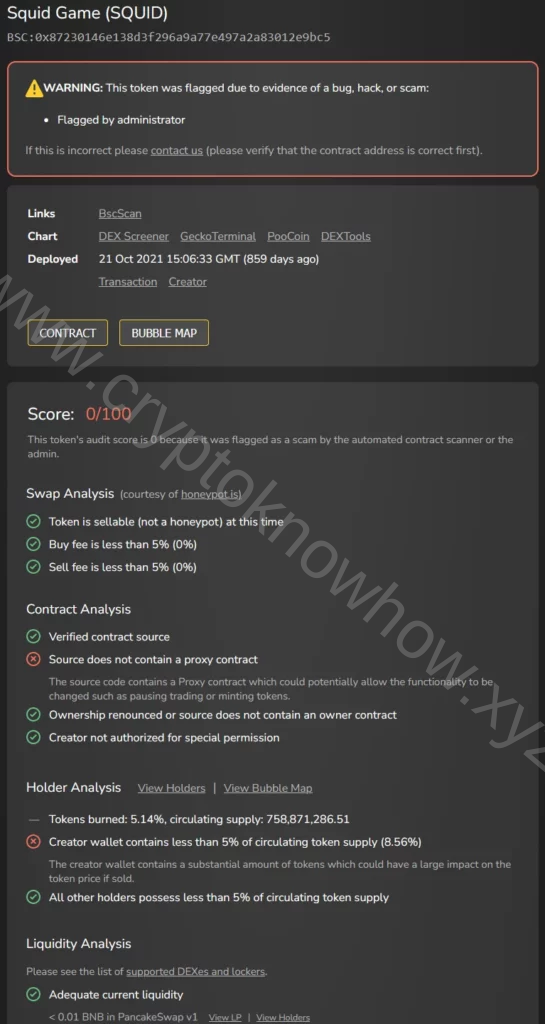

Example of a scam contract (Rug Pull):

Whitepapers

The whitepaper provides insights into a project’s objectives, mechanics, and purpose. Read this document in which you can learn about the team’s goals, technological framework, and tokenomics. Verify the actual problem statement and solution, while understanding the technical language. A well-detailed roadmap functions as a strategic guide, outlining the project’s developmental direction. Look for the team’s expertise, and try to understand if they can help shaping the cryptocurrency landscape or are just another token. A whitepaper serves as the key to understand a project’s potential and underlying intentions.

Roadmaps

Another good aspect for DYOR are roadmaps. Roadmaps serve as navigational tools and are often part of the above mentioned Whitepapers. A project’s roadmap outlines its planned milestones, development stages, and future goals, offering a detailed timeline of its plans. Reading the roadmap helps you and I understand the project’s ambition, transparency, and commitment to delivering on promises. It provides insights into the technological advancements, partnerships, and community-building initiatives, aiding investors in making informed decisions. By researching a project’s roadmap we can align our expectations with the project’s direction, making sure you are able to make a more informed approach to cryptocurrency investments. Plus, you can overtime check if they are meeting the promises they made!

Type of Coin

Why would the TYPE of coin or token matter? Well, there are different investment strategies and one of them is playing with MEME coins. Before we dive into that specifically, here are the different type of coins to invest in:

A. Digital currencies / Cryptocurrency:

Cryptocurrencies are decentralized digital assets that use cryptographic techniques to secure financial transactions and control the creation of new ‘units’. Cryptocurrencies operate independently of central banks or governments. Examples of cryptocurrencies:

- Bitcoin (BTC): Primarily serves as a decentralized digital currency, aiming to provide a peer-to-peer electronic cash system.

- Litecoin (LTC): Created as a “lite” version of Bitcoin, emphasizing faster transaction confirmations.

B. Altcoins:

Altcoins are alternative cryptocurrencies to Bitcoin and refers to a wide range of digital currencies. Each with its own unique features, purposes, and underlying technologies. Examples:

- Polkadot (DOT): Polkadot is a blockchain platform that facilitates interoperability between different blockchains, enabling them to transfer messages and value in a secure and decentralized manner, thus fostering a more interconnected and scalable web3 ecosystem.

- Cardano (ADA): Cardano provides a secure and scalable infrastructure for developing smart contracts and decentralized applications, focusing on sustainability, interoperability, and scalability.

C. Stablecoins:

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging their price to a stable asset such as fiat currency or commodities, providing a reliable medium of exchange and store of value in the volatile crypto market. They can be quite misleading in terms of the name, because they can become unstable. If they lose their peg, they become volatile in value, causing USDC, for example, to drop below $0.90 instead of maintaining its dollar value. Doesn’t happen often, but just to show that it is possible! Examples of Stablecoins:

- Tether (USDT): A stablecoin cryptocurrency that aims to maintain a value pegged to the US dollar, providing stability amidst market volatility.

- USDC (USDC): A stablecoin cryptocurrency that operates on blockchain technology, aiming to maintain a stable value equivalent to one US dollar, facilitating efficient and secure digital transactions.

D. Meme coins (DYOR!!!):

Meme coins are cryptocurrencies, often created as a joke or based on internet memes, which typically lack inherent value but attract attention and speculative investment due to their humorous or viral nature. Examples:

- Dogecoin (DOGE): Originally created as a parody based on a popular internet meme featuring a Shiba Inu dog, which has gained significant popularity and community support despite its initially humorous origins.

- PEPE (PEPE): Named after the popular internet meme featuring a cartoon frog, is a digital asset designed to embody the spirit of internet culture and enable decentralized creativity and expression.

Every type of coin comes with its own benefits and downsides. Meme coins are high risk, high reward, the earlier you are in, the more you can make. However, these are also classic pump and dump schemes, meaning that if you are too late your money is already gone. They are often ‘rugpulled‘.

Stablecoins exist in the crypto space to mitigate the volatility of traditional cryptocurrencies like Bitcoin and Ethereum by pegging their value to a stable asset like fiat currency, thus providing a reliable medium of exchange and a store of value within the crypto ecosystem.

Altcoins are alternatives to Bitcoin and Ethereum. A lot of coins are considered alt coins.

Partnerships

Often you see projects just throwing around brand names or relationships with certain popular people or digital characters. Always verify those partnerships and research what they exactly mean. Some questions to ask yourself:

- Is it a long-term partnership? Why? Or are they just using names of celebrities? And even so, what does that mean? Why would this benefit the project? How was it paid?

- What value will it bring?

- Is there an authentic connection?

- What results have previous collaborations produced?

Utilize audits for DYOR

Audits are additional safeguards against potential risks. Research whether a project has undergone third-party audits, involving a detailed evaluation of its code and security protocols. Place confidence in projects that engage with trusted audit firms, to have additional protection against vulnerabilities. Audits are however never a 100% guarantee and double check with the auditor they really did their job.